IT Managed Services

Interoperability in Hospitality: PMS, POS and Other Integrations for a Seamless Guest Experience

Why PMS-POS-Payment Integration Is a Key Challenge in Hospitality

In a hotel, the PMS plays a central role: it manages check-ins and check-outs, rooms, billing, and guest profiles. According to recent industry guidance, a properly integrated PMS synchronizes reservation data, payments, and ancillary services in real time.

In parallel, the POS covers restaurants, bars, room service, and retail outlets. If the POS is not connected to the PMS, charges may not be posted to the correct guest folio or revenue discrepancies may appear. Industry sources point out that PMS-POS integration improves billing accuracy and reduces errors.

Finally, card encoding and payment processing must also be integrated: the “room” or “guest” data from the PMS must be linked to the payment module to ensure full traceability and compliance (e.g., folio balance, extras, spa). Without this link, functional gaps appear: manual surcharges, double entry, risk of human error, or duplicate charges.

In summary, integration is essential to:

-

ensure all services (rooms, dining, spa) are billed in real time to the correct guest and account;

-

prevent losses due to synchronization errors or missing charges;

-

deliver a smooth guest experience without reminders, split invoices, or misrouted payments.

The Technical Foundations of Integration: APIs, Real-Time Flows, and Certification

For this interoperability to function reliably, several technical components must be mastered.

a) APIs, Webhooks, and Bidirectional Synchronization

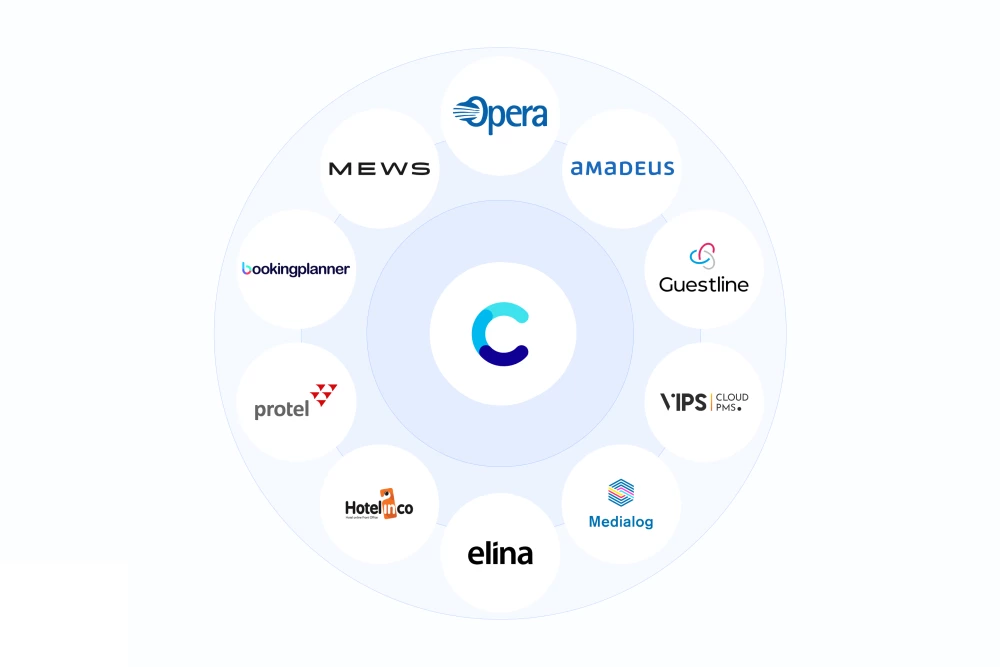

Modern hospitality systems use open APIs to connect the PMS, POS, payment processors, and more. According to industry documentation, integration often relies on REST APIs or a middleware platform acting as the bridge between PMS and other systems.

Synchronization must be bidirectional: when the PMS indicates that a room is cleared or a payment is processed, the POS or payment platform must be updated instantly. Without this, discrepancies appear (e.g., delayed billing, uncleared rooms).

b) Real-Time and Event-Driven Data Flows

Time is critical in hotels: check-ins, check-outs, extras, restaurant charges, and spa bookings create constant activity. Reports highlight that real-time synchronization prevents overbookings and inventory errors.

For example: when a guest orders room service, the POS must immediately push the charge to the PMS so the folio is accurate before checkout. This requires event-driven flows triggered by webhooks or system triggers.

c) Certification, Compatibility, and Payment Security

When integrating payments or card encoding, strict rules apply: PCI-DSS compliance, encryption, tokenization, and full traceability. An uncertified integration exposes the hotel to compliance issues and limited vendor support. For example, providers working with OPERA Cloud specify that non-validated interfaces cannot be fully supported.

Additionally, data exchange formats (folios, line items, ancillary services) must follow industry-structured fields: service type, room code, customer account, VAT, etc. The middleware or API must correctly map or transform these formats between POS, PMS, and payment modules.

Best Practices and Steps for Successful Hospitality System Integration

To ensure a successful integration project between PMS, POS, and payment/card encoding, the following steps and recommendations are key.

a) Map the Entire Ecosystem and Define Critical Data Flows

Identify all systems to be interconnected: PMS, POS, booking engines, card encoding, spa, retail, housekeeping…

For each system, define:

what data flows, in which direction, and at what frequency.

Example: POS charge → PMS folio ; final payment → card encoding → folio closure.

This prevents silos and clarifies dependencies.

b) Choose the Appropriate Architecture: Middleware or Native Connectors

Depending on the hotel’s technology environment (legacy vs cloud), two approaches are possible:

-

use native connectors provided by PMS or POS vendors (e.g., marketplace integrations), or

-

deploy a middleware / iPaaS platform that manages data translation, errors, and logs.

Middleware is especially useful when multiple heterogeneous systems must coexist.

c) Test, Validate, and Govern the Integration

Before going live, it is essential to test realistic scenarios:

-

check-in + restaurant bill + card authorization = correct folio;

-

early check-out + folio adjustment + refund;

-

bar over-consumption + different payment card + PMS update.

Once validated, establish governance: who maintains connectors, who monitors error logs, who updates APIs, and how system versioning is managed. Updates to PMS/POS should be planned so as not to break integrations.

d) Consolidate Data for Analytics and Upsell Opportunities

When PMS, POS and payments are fully integrated, consolidated data provides strong added value: consumption analytics by guest type, identification of high-performing services, targeted upsell campaigns.

According to industry insights, consolidated data can increase revenue and personalize guest experience.

For example: a bar customer spending above a certain threshold could automatically trigger an upgrade offer or spa package, based on POS data sent to the PMS.

MAG.

Wi-Fi & Network

Cybersecurity & Backup

Video Surveillance & Security

Consulting

IT Managed Services

IT Managed Services

IT Managed Services

Windows 10: End of Support in October 2025 – Prepare Your ...

End of Support: A Gradual but Real Risk Although computers running Windows 10 will still start and ...

+

+

IT Managed Services

GDPR for Hotels: What You Need to Know

GDPR in France: laws, enforcement, audits, and penalties The General Data Protection Regulation ...

+

+

Your hotel deserves IT excellence

Let's discuss your challenges, whether you're in the hospitality sector or an SME.